Purpose

This article aims to elucidate the workings of the Aldrich-Vreeland Act, which introduced a mechanism for augmenting national bank note circulation to address the issue of currency elasticity.

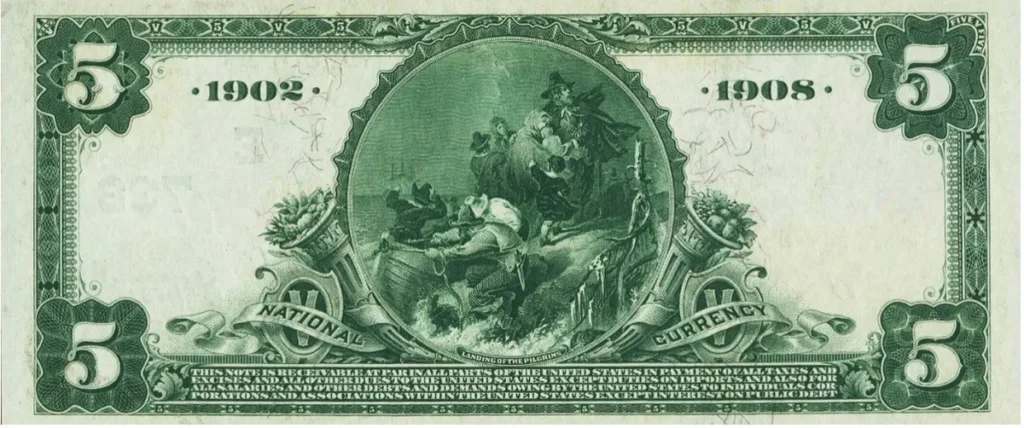

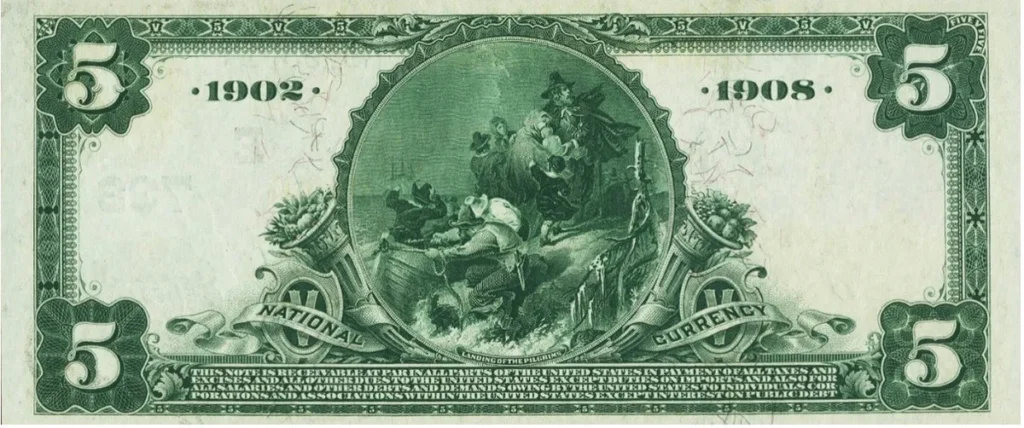

Enacted in response to the tumultuous Panic of 1907, the Aldrich-Vreeland Act sought to remedy the inelasticity of the national currency by allowing for the creation of emergency currency during times of financial strain.

Aldrich-Vreeland Act and Elasticity

The Aldrich-Vreeland Act, also known as the Aldrich-Vreeland Emergency Currency Act, was passed on March 30, 1908, as a response to the devastating Panic of 1907.

This crisis, triggered by the collapse of a speculative bubble in the stock market, inflicted widespread economic turmoil and underscored the deficiencies of the national currency system.

At the heart of the issue was the inelasticity of the national currency, which failed to adjust to fluctuations in demand or economic shocks.

Unlike modern fiat currency systems, the volume of national currency in circulation was tied to the capitalization of banks and remained static, regardless of economic conditions.

This rigidity led to erratic interest rate fluctuations and exacerbated financial crises, such as the Panic of 1907.

To address this fundamental flaw, the Aldrich-Vreeland Act proposed a novel solution: the creation of emergency currency to meet short-term liquidity needs.

This emergency currency would be issued based on the value of commercial loans held by banks, providing a flexible mechanism for injecting liquidity into the economy.

The Aldrich-Vreeland Act empowered banks to secure emergency currency by pledging short-term commercial loans as collateral.

Upon approval from the Comptroller of the Currency, banks could obtain a percentage of the loan value in emergency currency, effectively creating money out of thin air.

This newly minted currency could then be lent out by banks to meet the demands of borrowers and stimulate economic activity.

The key feature of this mechanism was its elasticity—the ability to expand and contract the money supply in response to changing economic conditions.

By leveraging short-term commercial loans as collateral, banks could tap into emergency currency during times of financial strain and retire it once stability was restored.

Outcome

The implementation of the Aldrich-Vreeland Act heralded a new era of monetary flexibility and resilience.

During periods of economic turmoil, banks could swiftly access emergency currency to stabilize financial markets and alleviate liquidity shortages.

This infusion of liquidity helped mitigate interest rate spikes and provided much-needed support to borrowers and businesses.

However, the effectiveness of the Aldrich-Vreeland Act was contingent on its tax structure.

Initially, the high tax rates imposed on emergency currency hindered its uptake, limiting its impact on the economy.

Subsequent amendments to the act, including tax reductions and extensions, bolstered its efficacy and facilitated greater adoption by banks.

Ultimately, the Aldrich-Vreeland Act paved the way for modern monetary policy frameworks, laying the foundation for the Federal Reserve Act of 1913.

By recognizing the importance of currency elasticity and introducing innovative mechanisms to address it, the act played a pivotal role in shaping the trajectory of monetary policy in the United States.

Federal Reserve Notes

The Aldrich-Vreeland Act foreshadowed the evolution of currency systems, laying the groundwork for the establishment of the Federal Reserve and the adoption of fiat currency.

Central to this transition was the recognition that money’s value derives not from intrinsic assets like gold, but from the confidence and trust placed in the underlying economic activity.

Modern Federal Reserve notes, backed by loans rather than gold reserves, exemplify this paradigm shift.

Through the process of rediscounting short-term commercial loans, banks can obtain currency from the Federal Reserve, thereby facilitating economic transactions and sustaining liquidity in the financial system.

In essence, the Aldrich-Vreeland Act heralded a paradigm shift in monetary theory, emphasizing the importance of currency elasticity and the dynamic relationship between money supply and economic activity.

By embracing innovative solutions to address financial crises and promote economic stability, the act laid the foundation for a more resilient and adaptable monetary system.