In the annals of American banking history, certain episodes stand out as remarkable anomalies, offering insights into the strategic maneuvers of astute financiers amidst the tumultuous backdrop of economic uncertainty.

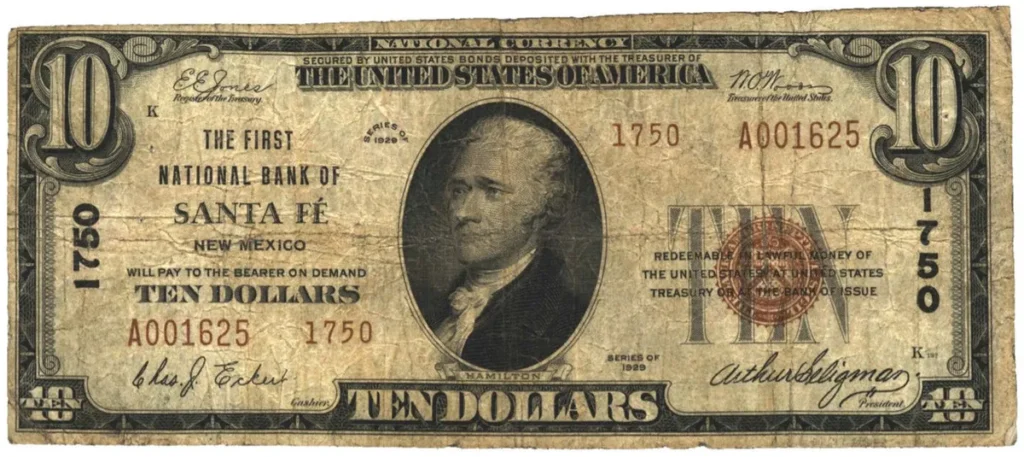

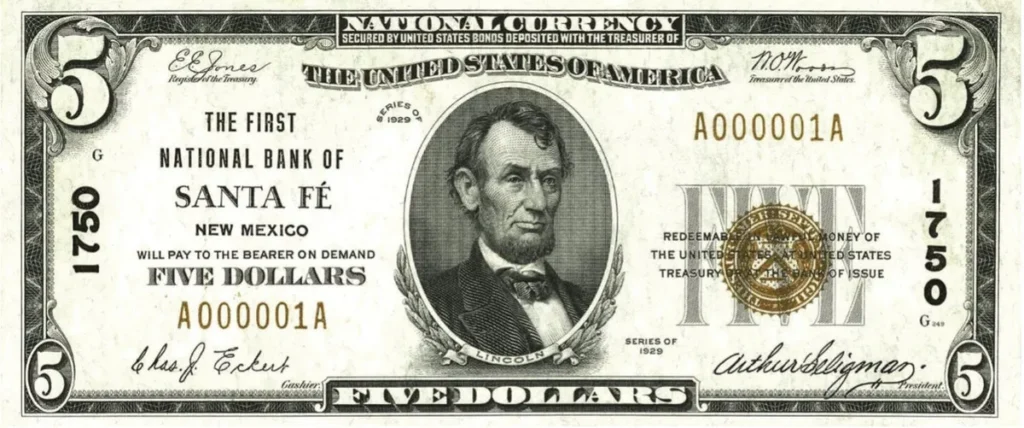

The brief but intriguing issuance of Series of 1929 notes by The First National Bank of Santa Fe, N.M., spanning just 10 months from March 23, 1933, to January 19, 1934, is one such episode that merits closer examination.

Delving into the available records from the Annual Reports of the Comptroller of the Currency and the National Currency and Bond Ledgers in the National Archives, we uncover a narrative rich in financial acumen and historical significance.

Arthur Seligman: A Visionary Banker and Statesman

At the heart of this story lies Arthur Seligman, a shrewd businessman and influential politician whose tenure as bank president coincided with a period of profound economic upheaval.

Born in Santa Fe, New Mexico Territory, in 1871, Seligman’s illustrious career spanned both the realms of commerce and public service.

As president of The First National Bank of Santa Fe from late 1924 until his untimely death on September 25, 1933, Seligman left an indelible mark on the financial landscape of New Mexico.

Seligman’s tenure at the helm of the bank was marked by strategic initiatives aimed at maximizing profitability and weathering the storms of the Great Depression.

His keen foresight and prudent management set the stage for the bank’s involvement in a unique bond play, which unfolded against the backdrop of the Federal Home Loan Bank Act of 1932.

Federal Home Loan Bank Act of 1932: A Catalyst for Opportunity

The passage of the Federal Home Loan Bank Act of 1932, amidst the depths of the Great Depression, presented an unexpected opportunity for Seligman and his associates.

Envisioned as an economic stimulus measure to promote homeownership, the act created a network of government banks to provide low-cost mortgages.

However, a little-known provision within the act, known as the Glass-Borah Amendment, held far-reaching implications for national banks seeking to bolster their profitability.

Championed by progressive lawmakers such as Senators Carter Glass and William Borah, the Glass-Borah Amendment granted a three-year circulation privilege for U.S. bonds with interest rates of 3-3/8 percent or less.

This provision, while ostensibly unrelated to the primary objectives of the Federal Home Loan Bank Act, presented an opportunity for national banks to leverage their liquid assets to invest in high-yield government bonds temporarily.

Seligman’s Strategic Moves: Seizing the Opportunity

Recognizing the potential windfall afforded by the Glass-Borah Amendment, Seligman wasted no time in capitalizing on the opportunity.

On March 21, 1933, The First National Bank of Santa Fe made a strategic decision to purchase $150,000 worth of Treasury 3 percent Bonds of 1951-55 to secure new currency issues.

This bold move positioned the bank to take advantage of the temporary circulation privilege afforded by the Glass-Borah Amendment, thereby maximizing profitability in the face of economic uncertainty.

The ensuing months saw the rapid issuance of Series of 1929 notes by the bank, facilitated by the newly acquired Treasury bonds.

Printed from a set of six 1-subject Barnhart Brothers & Spindler logotype plates, these notes entered circulation at a time of heightened financial volatility, providing much-needed liquidity to the local economy.

Conclusion: A Brief But Impactful Chapter in Banking History

The issuance of Series of 1929 notes by The First National Bank of Santa Fe represents a fascinating chapter in the annals of American banking history.

Driven by the strategic vision of Arthur Seligman and the unique economic circumstances of the Great Depression, this brief but impactful episode offers insights into the adaptive strategies employed by banks during times of crisis.

As collectors and historians continue to uncover and analyze such episodes, the legacy of Arthur Seligman and The First National Bank of Santa Fe serves as a testament to the enduring spirit of innovation and resilience in the face of adversity.

In the ever-evolving landscape of banking and finance, the lessons gleaned from the past continue to inform and inspire future generations of financial leaders and scholars alike.